If you’re self-employed, a sole trader, or operate as part of a partnership – you might be aware that as of April 2024, you’ll need to bring your accounting period in line with HMRC’s tax year. This change is known as the Basis Period Reform. In this article, we present a simple tool that sets out what action you should take in a flow chart format to ensure you meet the deadline for change in April 2024.

What is Basis Period Reform?

Partnerships, sole traders, and the self-employed have always been able to set their own accounting period – meaning year ends have not previously had to match the HMRC tax year which ends on 31 March/5 April. The change means that starting from 6th April 2024, unincorporated businesses will have to calculate business profits in line with the HMRC tax year. To avoid extra administrative burden, businesses therefore need to change their accounting period.

In August 2023, HMRC released some updated guidance clarifying the matter and confirming that 2023/24 was the transitional year and action should be taken.

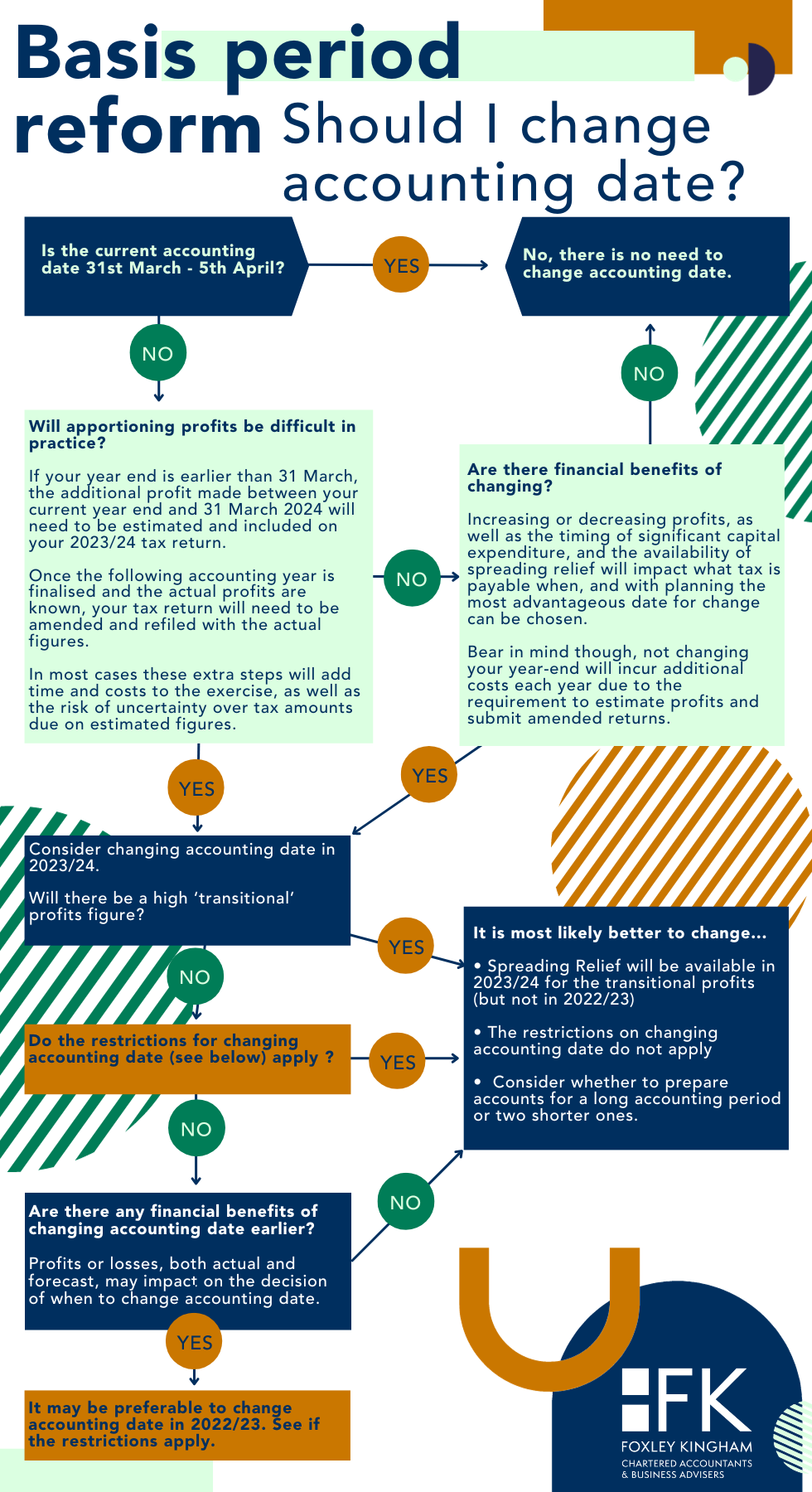

How do I know if I should change my accounting date?

The decision to change the accounting date has become increasingly significant in light of the Basis Period Reform. Changing the accounting date can have both benefits and drawbacks, and the specific implementation of the change can have implications for a trader’s tax position. While unincorporated businesses may have their own unique motivations for altering their accounting date, the following decision tree outlines the essential factors to consider when determining the reasons, timing, and method for changing the accounting date of an unincorporated business.

Restrictions on changing accounting date that apply in tax years other than 2023/24:

- Spreading relief will be unavailable

- Appropriate notice of the change must be given to HMRC

- The accounting period to the new accounting date must not be more than 18 months long

- Either:

- The accounting date cannot have been changed in the last 5 tax years, or

- If it has been changed in the last 5 tax years, the accounting date is being changed for valid commercial reasons, not for tax savings

If changing accounting date in 2023/24

Changing accounting date can either result in a long accounting period (over 12 months) or two shorter accounting periods (12 months plus the remainder). The restriction on the length of accounting periods does not apply when the accounting date is changed in 2023/24. This means that an accounting period that ends on 31 March/5 April 2024 can be over 18 months long. The question is whether to split the long accounting period into two shorter ones (12 months plus the remainder) or apportion the results of a longer accounting period. In some cases, where profits are incurred unevenly, splitting an accounting period (or not) could affect the amount of transitional profits, which are subject to spreading relief.

So what do I do next?

For more information regarding Basis Period Reform, you can refer to the earlier mentioned guides and hopefully, our infographic has helped you decide what actions to take.

We will of course be assessing this on behalf of our clients and making recommendations on how this will affect you and what you can do to manage it.

However, if you’d like to discuss Basis Period Reform in more detail, or get a plan in place to reach the April deadline – please get in touch and we can assist.